After a successful public sale on Legion and Kraken Launch, YieldBasis has become a focal point in the market. Not only that, thanks to its bold approach to handling Impermanent Loss and being initiated by Michael Egorov (Curve Finance), with direct support from CurveDAO with a credit line of 60 million crvUSD, YieldBasis is definitely a name worth noticing on the DeFi map in the near future. Let's join Hak Research to delve deeper into YieldBasis in this article.

Before digging into the article, everyone can refer to some articles below for a better understanding of the knowledge in the Crypto market.

- Metamask & Base Ready for TGE: Should the Market Celebrate or Worry?

- Flying Tulip Analysis: Opportunities with an Innovative Fundraising Model

- Limitless Pre Sales Analysis: Sweet Opportunities on Kaito Capital Launchpad

Overview of YieldBasis

YieldBasis is a DeFi protocol uniquely designed for BTC/ETH liquidity. The standout feature of the project is its aim to completely eliminate the issue of Impermanent Loss – a significant barrier that causes many liquidity providers (LPs) to incur losses compared to just holding the original assets. Instead of accepting IL as a cost of doing business, YieldBasis restructures the AMM mechanism from the ground up to eliminate this risk.

YieldBasis was initiated by Michael Egorov - the founder of Curve Finance. Aside from the personal factor, the project has also received significant backing from CurveDAO with a credit line of 60 million crvUSD to support initial liquidity. This is seen as a solid foundation for YieldBasis to expand its scale, test new models, and aim to become a sustainable Yield infrastructure for the BTC/ETH liquidity pair, and eventually expand to other liquidity pairs designed for bluechip assets like BNB, Sol,... in the market.

Early Success From Public Sale Process

Recently, YieldBasis has successfully implemented a Public Sale on 2 platforms, Legion and Kraken, with a sale price set at 0.2 USD/YB, equivalent to an FDV of 200 million USD. In terms of allocation, the Public Sale accounts for 2.5% of the total supply corresponding to 25 million YB and these tokens are evenly distributed between the two distribution channels, Kraken Launch and Legion. Specifically, on Kraken, the sale amount is 1.25% of the total supply while the remainder is sold on Legion. The main sale format is FCFS (First Come First Served), but for Legion, there will be an additional Merit Based Presale phase for users with a high Legion Score.

The entire sale process was extremely successful, as YieldBasis garnered interest far beyond initial expectations. According to statistics on Legion, over 60,000 wallet addresses participated in registration with a committed amount of up to 195 million USD, which is an Oversubscribe of nearly 98 times. As for Kraken Launch, the sale process also concluded quickly just seconds after opening, showing the popularity of YieldBasis is immense.

Currently, YieldBasis is trading PreMarket on Whale Market at a price up to 0.92 USD, equivalent to an FDV of 920 million USD. This means that those who managed to buy tokens during the Public Sale have profits of nearly 5 times. Of course, this is just the initial price, and it is believed that if YieldBasis announces listings on major CEXs like Binance, OKX, or Upbit, the token price could be even higher.

Unique Structural Model

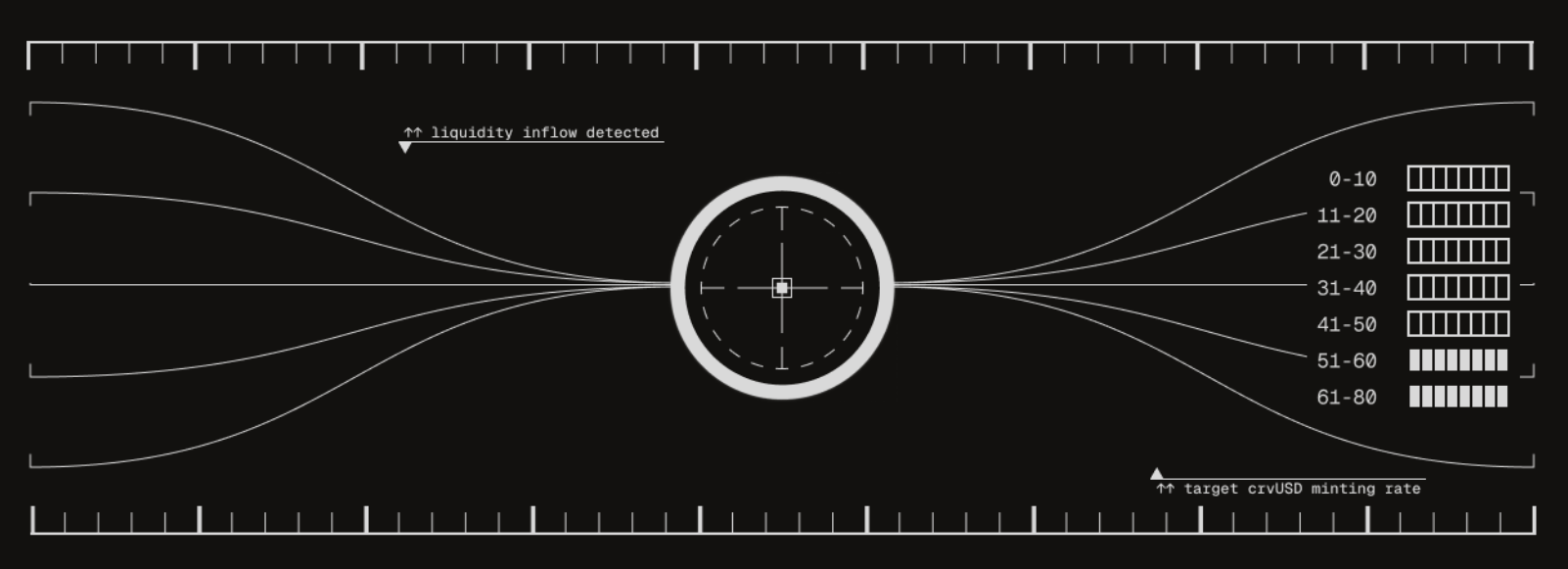

2x Leverage + Borrowing crvUSD

The core mechanism of YieldBasis begins with LP depositing BTC or ETH into the Vault. After receiving assets from users, the protocol borrows crvUSD to additionally purchase an equivalent amount of BTC/ETH. As a result, the LP's position is magnified to a 2x leverage compared to the initial capital. Importantly, the system always maintains a Delta ratio close to 1 with the original asset, meaning the PnL fluctuations (profit – loss) of the LP will approximate that of simply holding BTC/ETH instead of traditional liquidity provision.

When market prices change, the Vault automatically performs rebalancing to maintain a stable Delta ratio. In the mathematics of YieldBasis, Impermanent Loss (IL) is no longer viewed as a loss in the traditional sense but is translated into an Implied Fee Stream. This implied fee source will cover the rebalancing costs and the interest on the borrowed crvUSD, thereby in the long run, LPs will not lose compared to Hodling but can also gain additional profits from Yield.

Yield Source

The profits of LPs in YieldBasis come from several different layers. First, there are AMM trading fees collected from users swapping in the pool. Second, there are the gains generated through the rebalancing process – this mechanism converts price volatility into benefits rather than risks. Additionally, the strategy of using borrowed crvUSD helps optimize capital costs: LPs do not need to invest their entire initial assets while still holding a doubled position.

An important advantage of YieldBasis is that it is directly integrated with the Curve ecosystem. CurveDAO has approved a credit line of 60 million USD crvUSD to support the launching protocol, serving as a liquidity launchpad. As a result, YieldBasis's pools benefit from the existing liquidity of Curve and crvUSD, helping to reduce trading costs and enhance scalability from the very beginning.

Moreover, YieldBasis is also planning to launch assets representing the position deposited in the Vault. For example, when users deposit BTC into the Vault, they can receive ybBTC tokens - this is a type of Wrapped Asset representing the deposit. These tokens not only maintain a Delta~1 with BTC (meaning their value moves closely with BTC) but also reflect the accumulated Yield generated by the Vault. This provides flexibility: users can trade, transfer, or use ybBTC in other DeFi applications without needing to withdraw their original assets from the Vault.

Could YieldBasis Be a New Direction for AMM Trends?

In traditional AMM models, Impermanent Loss is the most challenging issue for LPs. When the asset prices in the pool deviate from the original ratio, the value of the LP’s position decreases compared to simply holding the assets. Over the long term, if trading fees do not cover the losses, LPs may experience lower performance than just holding the original coins. This is why many LPs do not commit long-term to traditional AMMs, especially in pairs with high volatility.

YieldBasis offers a completely different approach. Instead of LP directly facing volatility, the protocol employs 2x leverage and combines it with an Auto Rebalance mechanism to anchor the ratio of the original assets that liquidity providers deposit into the pool. In other words, even while participating in the pool, LPs can maintain a hodl-like state of the core assets while simultaneously profiting from trading fees.

The issue with traditional AMMs is that the users' positions are continuously rebalanced between BTC and Stablecoin. When BTC rises, users have already sold too early, and when it drops, users buy more as the price falls. Here’s an example:

- Initially Add Liquid with 1 BTC (price of 100,000 USD) + 100,000 USDC

- When the price rises to 200,000 USD, the current position in the AMM is 0.7 BTC + 141,000 USD, equivalent to 283,885 USD

- If we simply hodl, we would have 300,000 USD, meaning providing liquidity has generated an Impermanent Loss of ~5.7% (if the fees are not greater than this IL, the LP's performance is certainly lower than just hodling the assets)

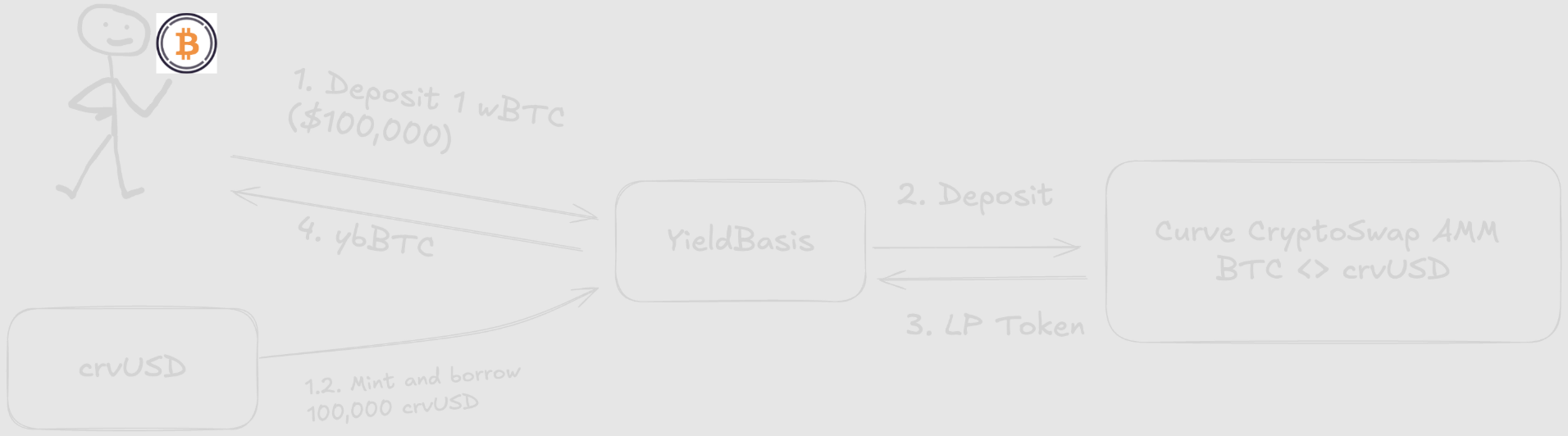

YieldBasis enables LP positions to move at a 1:1 ratio with BTC by coupling BTC with borrowed crvUSD and maintaining the position at a fixed 2x leverage. This is executed as follows:

1. Borrow & pair:

- Users deposit BTC into YieldBasis → receive ybBTC

- The protocol borrows an amount of crvUSD = USD value of BTC through CDP

- Then pairs BTC + crvUSD into the Curve Pool (BTC/crvUSD)

2. LP token serves as collateral asset

- The received asset is Curve LP Token

- This LP is locked to serve as collateral for the crvUSD debt

- Thus, the structure always maintains 50% equity/50% debt --> fixed 2x leverage

3. Auto Rebalance

- If BTC rises: LP value increases, the initial debt remains unchanged --> debt/equity ratio < 50%. At that point, the Rebalancing AMM mechanism together with the VirtualPool will facilitate arbitrageurs injecting more crvUSD to mint more LPs, thus raising debt to the correct level of 50% and returning the leverage to the standard 2x.

- If BTC falls: LP value decreases, the initial debt remains unchanged --> debt/equity ratio > 50%. At this point, arbitrageurs will see profits by withdrawing LP, selling crvUSD, and repaying debt. The system will burn some LP, reducing debt to the correct level of 50%.

Both directions are processed via an Atomic Swap through the VirtualPool, incorporating internal Flash loans, and above all, users will no longer suffer Impermanent Loss when participating in Add Liquid. This is achieved since the LP's prices have moved linearly (∝ p), which is exactly like holding 1 BTC rather than square root p as is the current situation in AMMs.

The emergence of YieldBasis opens up new opportunities for users wanting to profit from providing liquidity, especially for those holding BTC, as the issue of Impermanent Loss has been resolved. However, YieldBasis is still in the conceptual stage and has yet to be validated in real-world operations where many different variables could come into play. If successful, this could be a highly promising new direction for AMMs.

Conclusion

YieldBasis presents a unique solution to the Impermanent Loss problem by combining 2x leverage, auto-rebalance mechanisms, and borrowing crvUSD. Although the project is still in its early stages, its success exceeding expectations during the public sale, along with support from CurveDAO, shows that YieldBasis has a solid foundation to become a new generation AMM infrastructure. If validated in practice, this could mark a turning point for the entire decentralized liquidity provision field.